Purchase Invoice with Retainage

Invoice Header

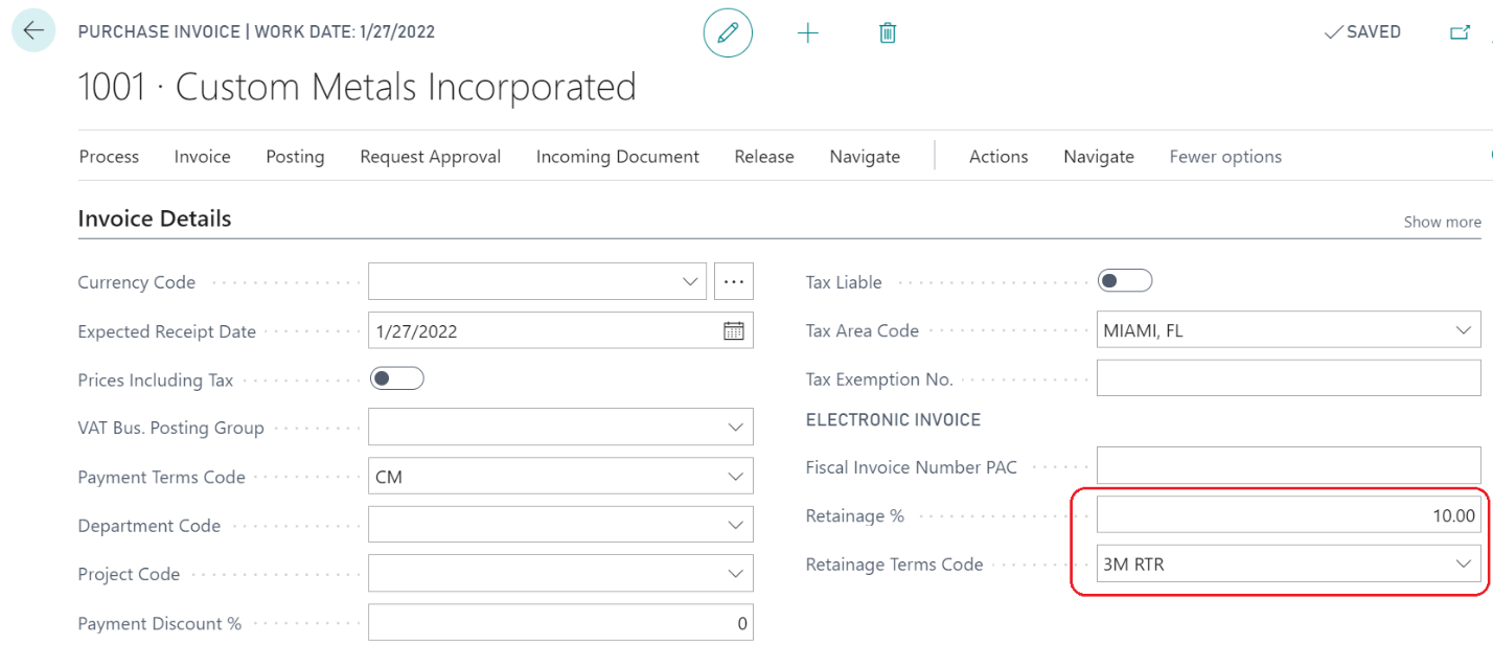

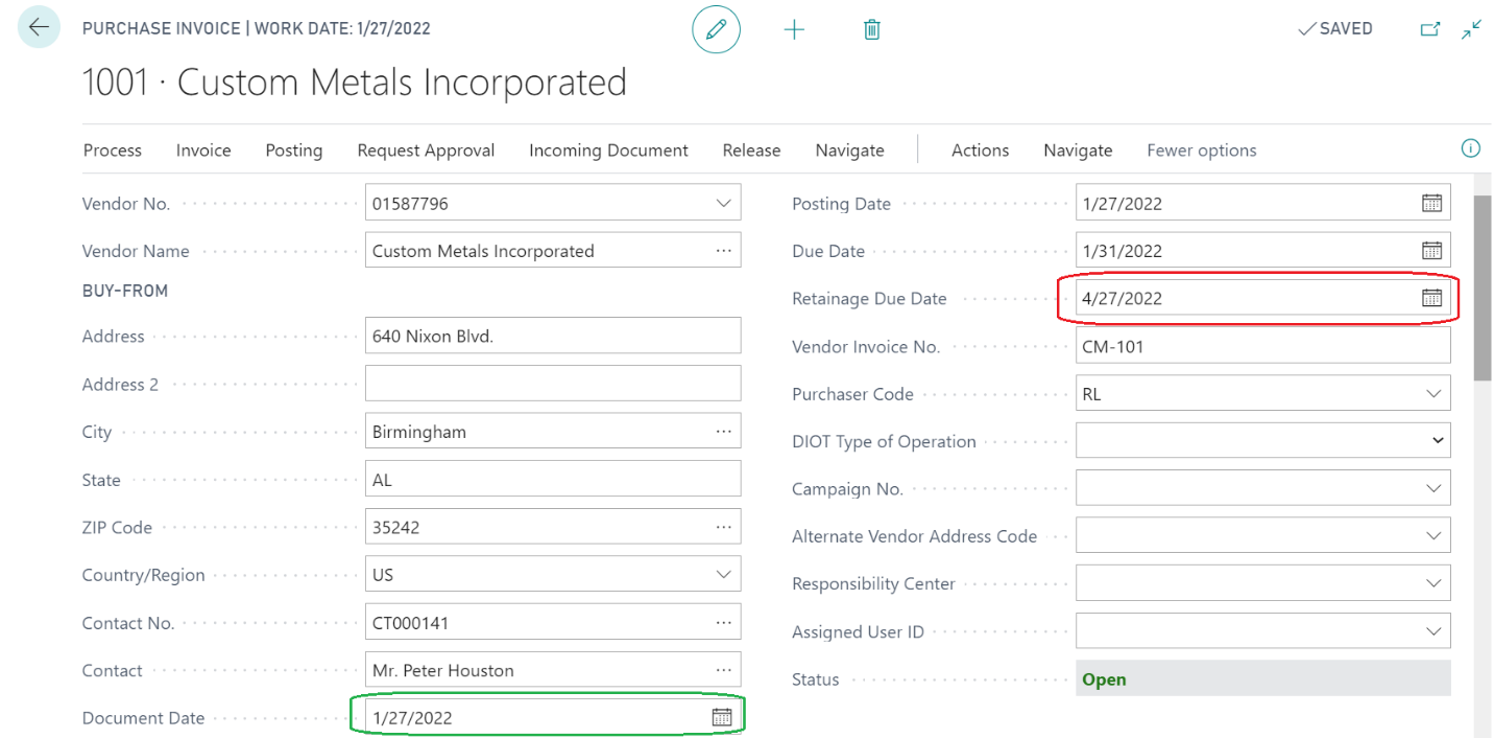

The Purchase Invoice contains the following fields related to retainage.

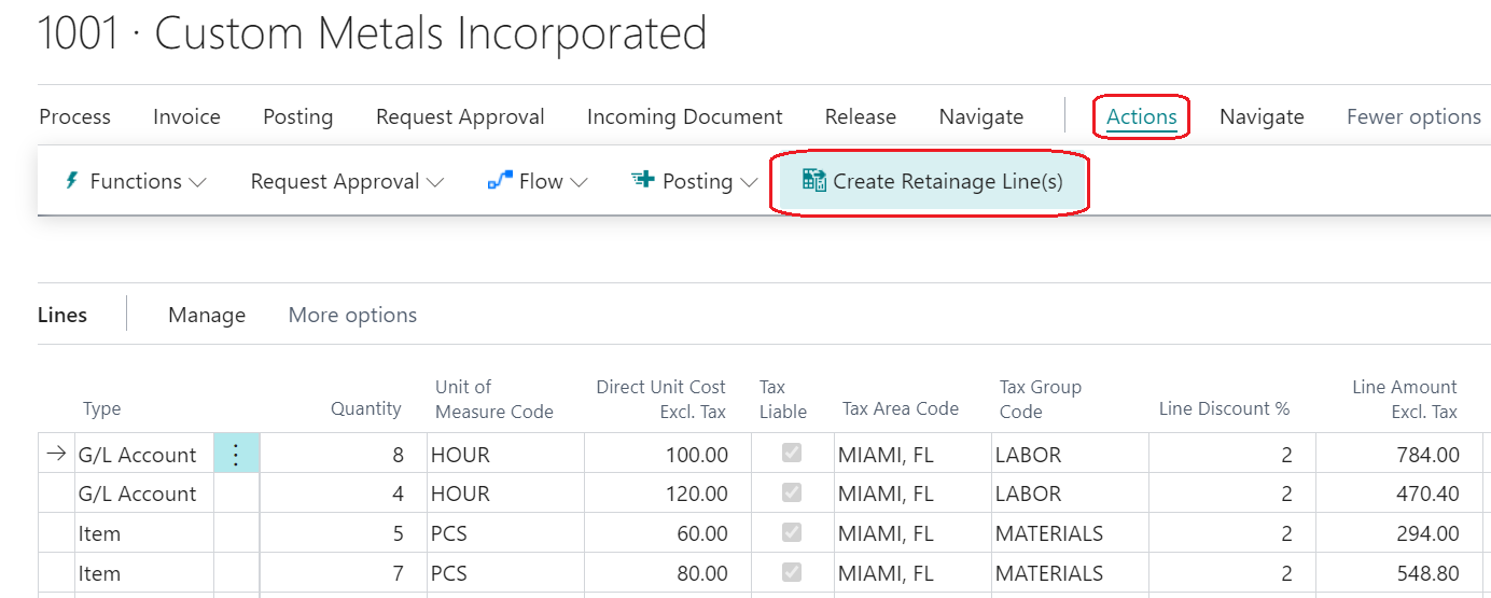

Creating Retainage Lines

After entering invoice lines, run the action "Create Retainage Line(s)"

The results of this action will be the following:

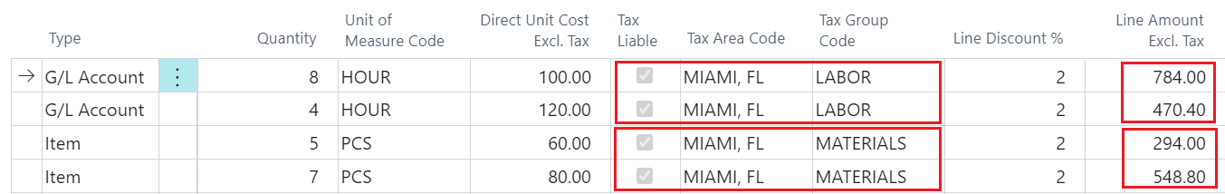

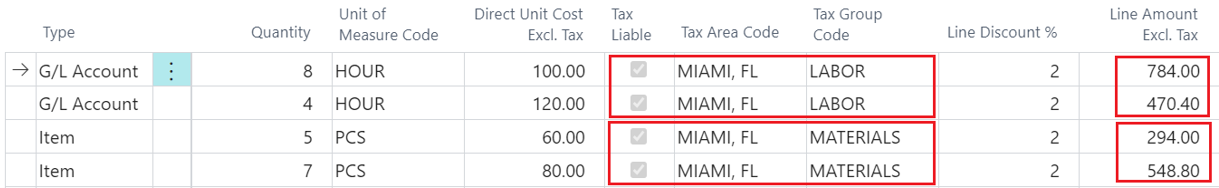

- Retainage lines will be created, one line for each tax combination of Tax Liable/Tax Area Code/Tax Group Code in regular (non-retainage) purchase lines.

- The Tax Liable, Tax Area Code, and Tax Group Code in retainage lines have been populated with corresponding values of the tax combinations.

- The Direct Unit Cost is calculated as a percentage of the sum of "Line Amount Excl. Tax" in purchase lines of each tax combination taken with a negative sign. The percentage is defined in the field "Retainage %" (which is equal to 10% in this example).

-1 * (784.00 + 470.40) * (10%/100%) = -125.44

-1 * (294.00 + 548.80) * (10%/100%) = -84.28

You can also create a retainage line manually by specifying the negative "Direct Unit Cost Excl. Tax" and marking the flag "Retainage". Column "Retainage" is editable if the flag "Allow Manual Retainage Lines" in the "Purchase & Payables Setup" is set to "Yes".

Posting purchase invoice with retainage lines

Posting purchase invoice creates:

- Vendor Ledger Entries

- Vendor Retainage Entries

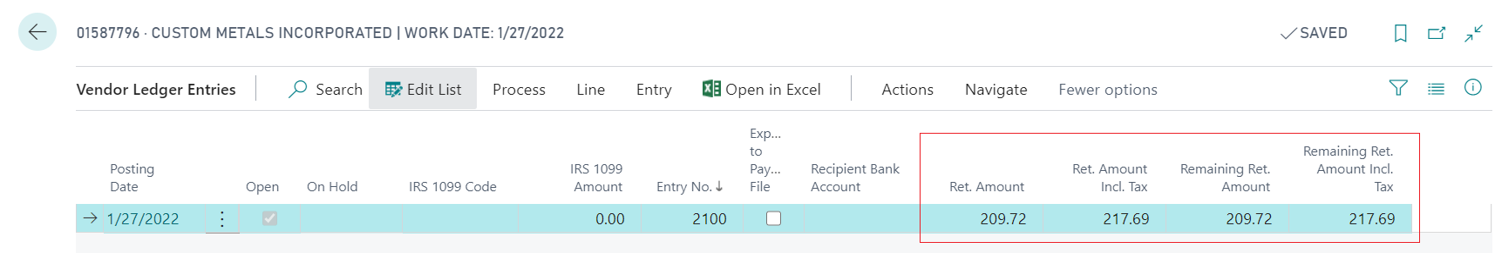

Vendor Ledger Entries

Vendor Ledger Entry for the posted invoices shows extension fields:

- "Ret. Amount" (Retainage Amount)

- "Ret. Amount Incl. Tax" (Retainage Amount Including Tax)

- "Remaining Ret. Amount" (Remaining Retainage Amount)

- "Remaining Ret. Amount Incl. Tax" (Remaining Retainage Amount Including Tax)

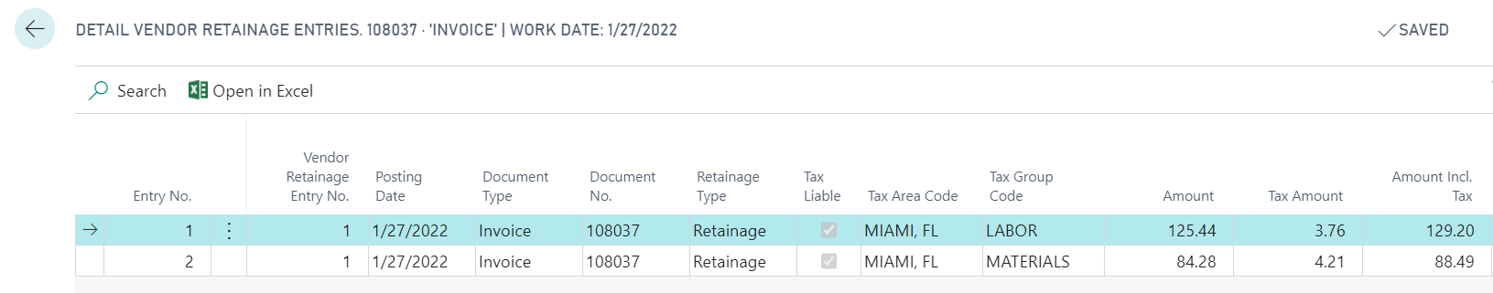

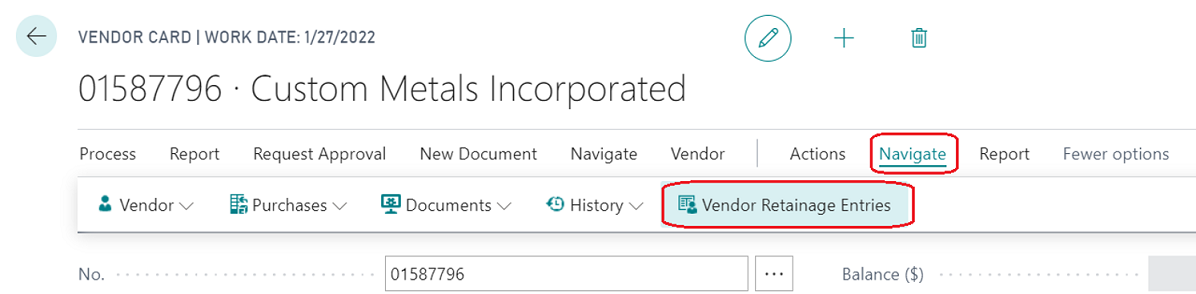

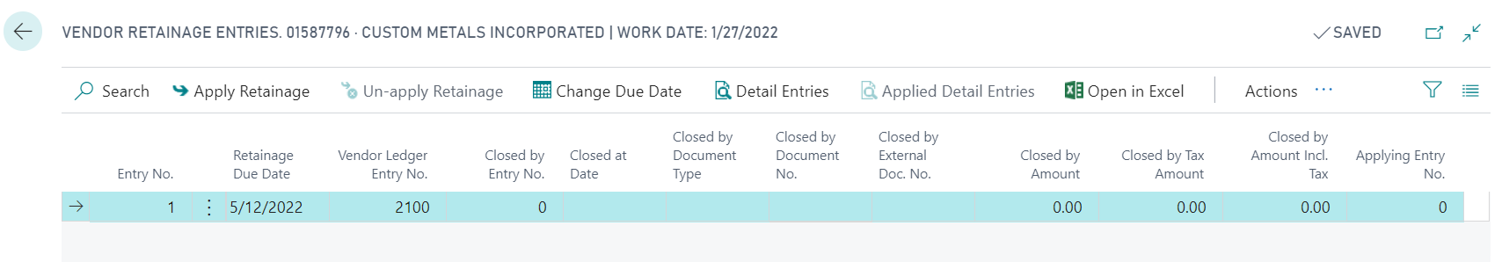

Vendor Retainage Entries

If a purchase document has retainage lines then upon posting the system will create a record of Vendor Retainage Entry, which is a special sub-ledger to store and manage retainage records.

To view Vendor Retainage Entry, go to Vendor Card “Navigate” “Vendor Retainage Entries.”

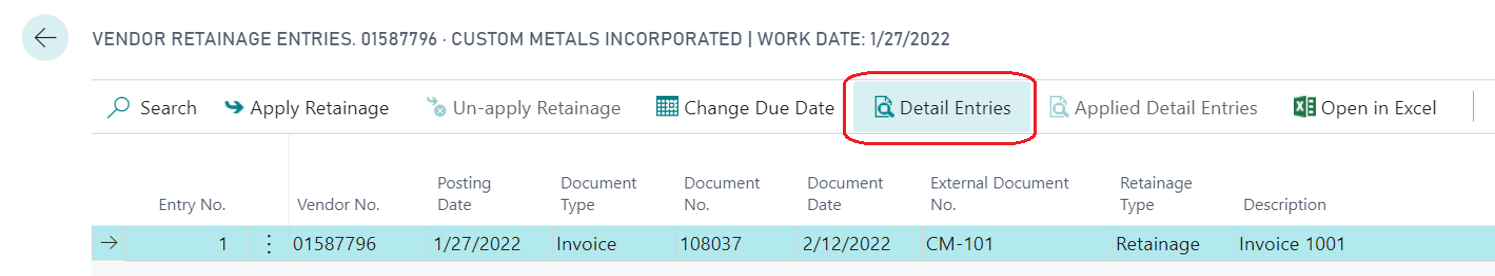

To view Detail Vendor Retainage Entry, press "Detail Entries" for the selected record on the "Vendor Retainage Entries" page.

In this example, there are two "Detail Vendor Retainage Entry" records representing each tax combination (Tax Liable, Tax Area Code, Tax Group Code).